Corporate Governance

Maximizing Transparency and Compliance with Legal Entity Management: The Power of Automated Visual ChartsBy Isabela Godoy · April 19, 2024 · 3 minute read

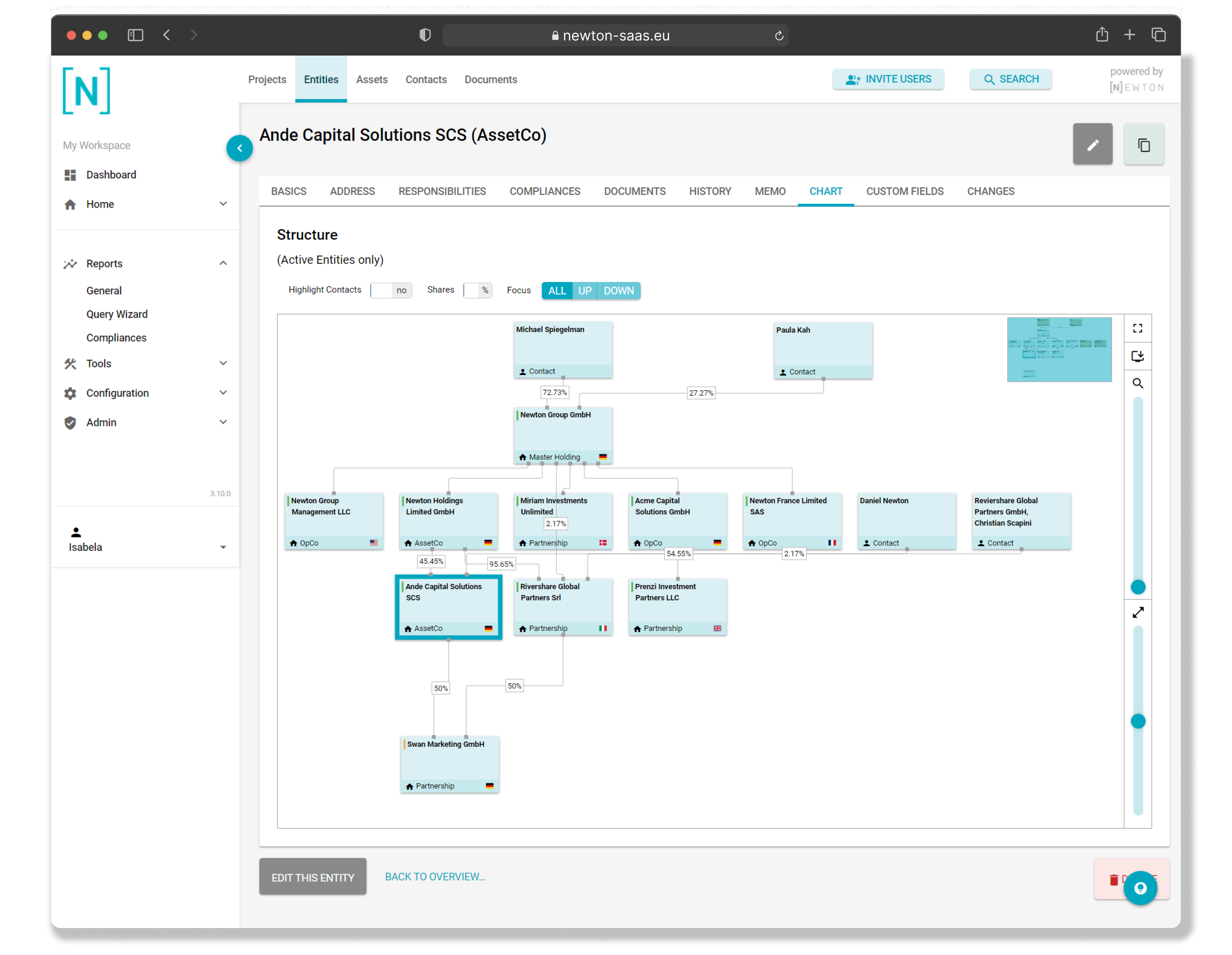

Managing data in spreadsheets poses inherent risks, including human error and time-consuming manual processes. In this article, we explore how automated visual charts ...

Corporate Governance

Cybersecurity & Governance: Navigating the ChallengesBy admin · June 5, 2023 · 9 minute read

Uncover the link between cybersecurity risks and corporate governance, learn about threats, proactive measures, and safeguarding data. Stay protected with expert advice and ...

Corporate Governance

Corporate Social Responsibility in Legal OpsBy admin · May 3, 2023 · 11 minute read

The need-to-knows of corporate social responsibility and how it impacts legal operations. Explore this article to start building CSR into your legal operations. ...

Corporate Governance

What is ESG? A Guide for Legal TeamsBy admin · May 2, 2023 · 8 minute read

ESG has become an important topic for in-house legal teams globally. But what exactly is it? This article acts as an introduction to ...

Corporate Governance

Maximize Real Estate ROI in Netherland and IrelandBy admin · April 19, 2023 · 8 minute read

This article will teach you about the different legal entities available to real estate investors in the Netherlands and Ireland. Real estate investment ...

Corporate Governance

SVB disaster, what Legal Ops can learnBy admin · March 31, 2023 · 12 minute read

The recent news of Silicon Valley Bank’s collapse sent shockwaves through the industry. But what can in-house legal teams learn from the SVB ...