Corporate Governance

Maximizing Transparency and Compliance with Legal Entity Management: The Power of Automated Visual ChartsBy Isabela Godoy · April 19, 2024 · 3 minute read

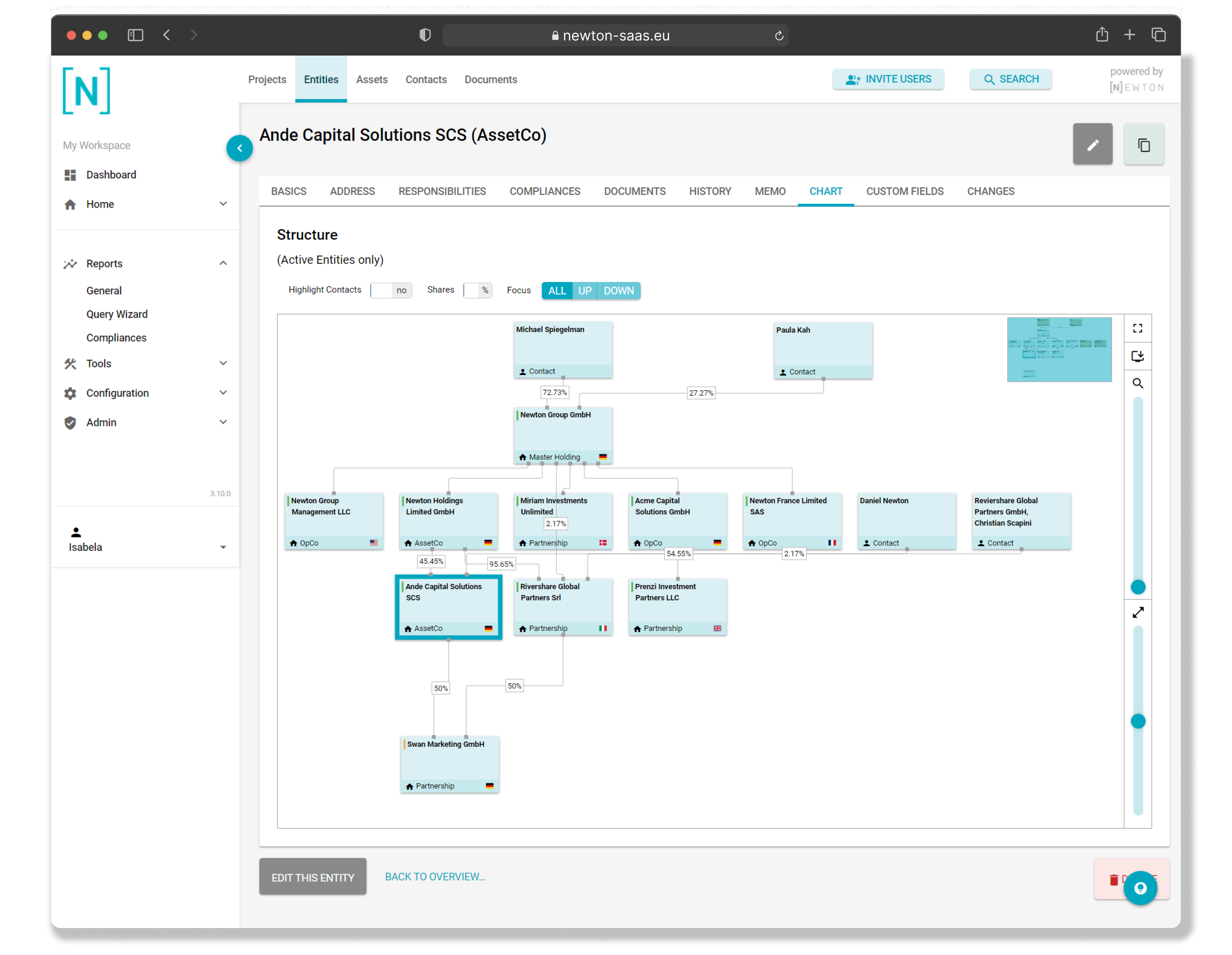

Managing data in spreadsheets poses inherent risks, including human error and time-consuming manual processes. In this article, we explore how automated visual charts ...

Corporate Governance

Cybersecurity & Governance: Navigating the ChallengesBy admin · June 5, 2023 · 9 minute read

Uncover the link between cybersecurity risks and corporate governance, learn about threats, proactive measures, and safeguarding data. Stay protected with expert advice and ...

Corporate Governance

SVB disaster, what Legal Ops can learnBy admin · March 31, 2023 · 12 minute read

The recent news of Silicon Valley Bank’s collapse sent shockwaves through the industry. But what can in-house legal teams learn from the SVB ...

Corporate Governance

What is Legal Entity Management?By admin · March 3, 2023 · 7 minute read

Discover the foundations of legal entity management, entity management identifiers, requirements, and the benefits of LEM software. As businesses scale and adapt, companies ...

Corporate Governance

The value of Transparency in Corporate GovernanceBy admin · February 24, 2023 · 7 minute read

Law is ever-evolving, and new challenges and regulations are constantly arising. This article dives into the unifying value of transparency in corporate governance ...